16nm for alt coin mining

20 Nov 2017 by 7400

Imagine if cars became twice as fast, and cost half as much every two years. A strange world that would be. But that’s exactly the situation in semiconductor technology. That’s why your phones and laptops become obsolete so quickly. Sure you can try to use a seven year old phone, but quickly you find it won’t keep up.

How is this exponential improvement possible? The semiconductor industry is a huge machine consisting of a half dozen competing foundries that iterate on semiconductor technology to improve as quickly as human ingenuity and economics allows. Each iteration builds on the previous. Not only on the physics and engineering, but on the ecosystem of companies developing equipment for the fabrication lines. Every two years, the entire industry achieves the next increment in improvement.

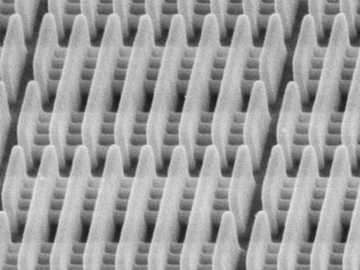

Thus the 28nm process progresses to 20, then to 16, then 10, and 7, and 5, etc. each generation improving on the previous by a factor of two. Each nm number is called a “node”, and represents the size of a transistor. “nm” stands for nanometer, one billionth of a meter. By comparison a human hair is about 100 millionths of a meter. So a 28nm transistor is about 4000 times smaller than a human hair.

Smaller is better because the transistors operate more quickly and with less power. It’s a principle of physics that smaller consumes less power (all other things being equal.) It takes much less energy to move aside a mosquito than a 75lb golden retriever.

Great, let’s build everything at the smallest node possible! The spoiler here is that tooling costs, known as non-recurring-expense or NRE, increase exponentially as the nodes get smaller. Most of that NRE is for masks, essentially the optical negative that is used to print transistors onto a wafer. So a 28nm mask costs twice 40nm, and 16nm twice 28nm, and 7nm four times 16nm, to the point where 7nm NRE is in the 8 digits. That’s a big barrier to entry.

Today in 2017, the most advanced production node is at 10nm. The 16nm node has been in production barely four years. The 28nm node is two generations further back. But 28 sits at a sweet spot. It is still powerful enough to have wide applicability, but mature enough to be affordable — the fabs have now been paid off over 8 years of sales. The 28nm node a great target if you are building an alt coin mining ASICs today. However next year its sweet position will be displaced as the economics of 16nm crosses over, coinciding with the beginning of production at 7nm.

Currently bitcoin ASICs are produced at 16nm. Next year some of the very first ASICs to be produced at 7nm will be for bitcoin. Those efforts are paying astronomical 8 digit NRE amounts for the first spots in the pipeline. They are compelled to because power consumption is critical in the economics of bitcoin mining, and they can afford to because their volumes are so high. Bitcoin has become a huge business for the semiconductor industry.

For the altcoin ASIC designer, 7nm is not an option. The economics just don’t support it yet. The choice is between 16 and 28. So looking toward the future, dcrASIC is choosing 16nm.

Further reading: